Homeowners depreciation calculator

Use this calculator specifically to calculate depreciation of residential rental or nonresidential real property related to IRS form 4562 lines 19 and 20. Ad Compare 10 Low Cost Insurance Plans For Your Best Options.

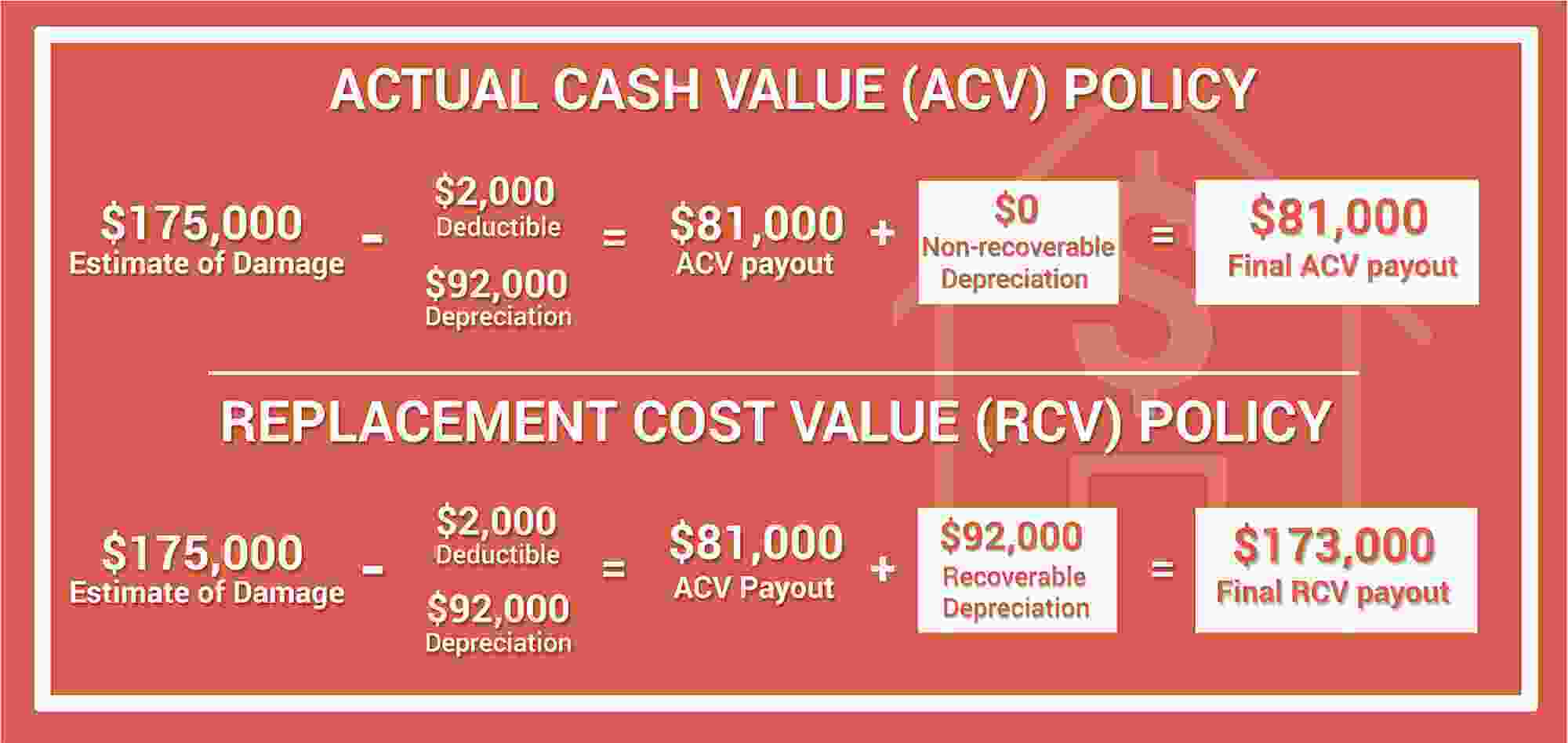

Replacement Cost Value Rcv Vs Actual Cash Value Acv

This calculator calculates depreciation by a formula.

. Under most insurance policies claim reimbursement begins with an initial payment for the Actual Cash Value ACV of your damage. The Good Calculators Depreciation Calculators are specially programmed so that they can be used on a variety of browsers as well as mobile and tablet devices. This depreciation calculator is for calculating the depreciation schedule of an asset.

See Your Quotes Today. A deck valued at 10000 might depreciate 500 per year. A P 1 R100 n.

There are many variables which can affect an items life expectancy that should be taken into consideration. This slider represents the number of years youve owned the home or plan to own the home. Where Di is the depreciation in year i.

The calculator allows you to use. The calculator should be used as a general guide only. There are several options to calculate depreciation.

Percentage Declining Balance Depreciation Calculator. Non-ACRS Rules Introduces Basic Concepts of Depreciation. To do it you deduct the.

Also includes a specialized real estate property calculator. Where A is the value of the home after n years P is the purchase amount R is the annual percentage. If an accident occurs five years into an established homeowners insurance policy the deck will be valued at 7500.

There are many variables which can affect an items life expectancy that should be taken into consideration. The home appreciation calculator uses the following basic formula. The most straightforward one typically used for home improvements is the straight-line method.

The MACRS Depreciation Calculator uses the following basic formula. There are many variables which can affect an items life expectancy that should be taken into consideration. See the results for Fixed asset depreciation calculator in Washington.

First one can choose the straight line method of. For every year thereafter youll depreciate at a rate of 3636 or 359964 as long as the rental is in service for the entire year. The calculator should be used as a general guide only.

It provides a couple different methods of depreciation. Typically the longer you own your home the more it will appreciate in value. Cheapest Home Insurance Quotes Across the US.

Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods. The IRS also allows calculation of.

D i C R i. C is the original purchase price or basis of an asset. Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures.

For example if you have an asset. The calculator should be used as a general guide only. When an asset loses value by an annual percentage it is known as Declining Balance Depreciation.

Note that this figure is essentially equivalent to. This loss in value is commonly known as depreciation. It assumes MM mid month convention and SL straight-line depreciation.

Home Depreciation Simplified Guide Trusted Choice

Understanding Rental Property Depreciation 2022 Bungalow

How To Recover Depreciation On An Insurance Claim

Should You Sell Or Rent Your Home Before A Military Move Military Move Buying First Home Moving

How To Understand Depreciation On Your Roof Insurance Claim

How To Calculate Depreciation On A Rental Property

Payment Schedule Template Excel Unique 8 Printable Amortization Schedule Templates Ex Amortization Schedule Schedule Templates Mortgage Amortization Calculator

What Recoverable Depreciation Means And How To Calculate It

The Hidden Costs Of Selling Your Home Selling House Home Warranty Companies Things To Sell

Appliance Depreciation Calculator

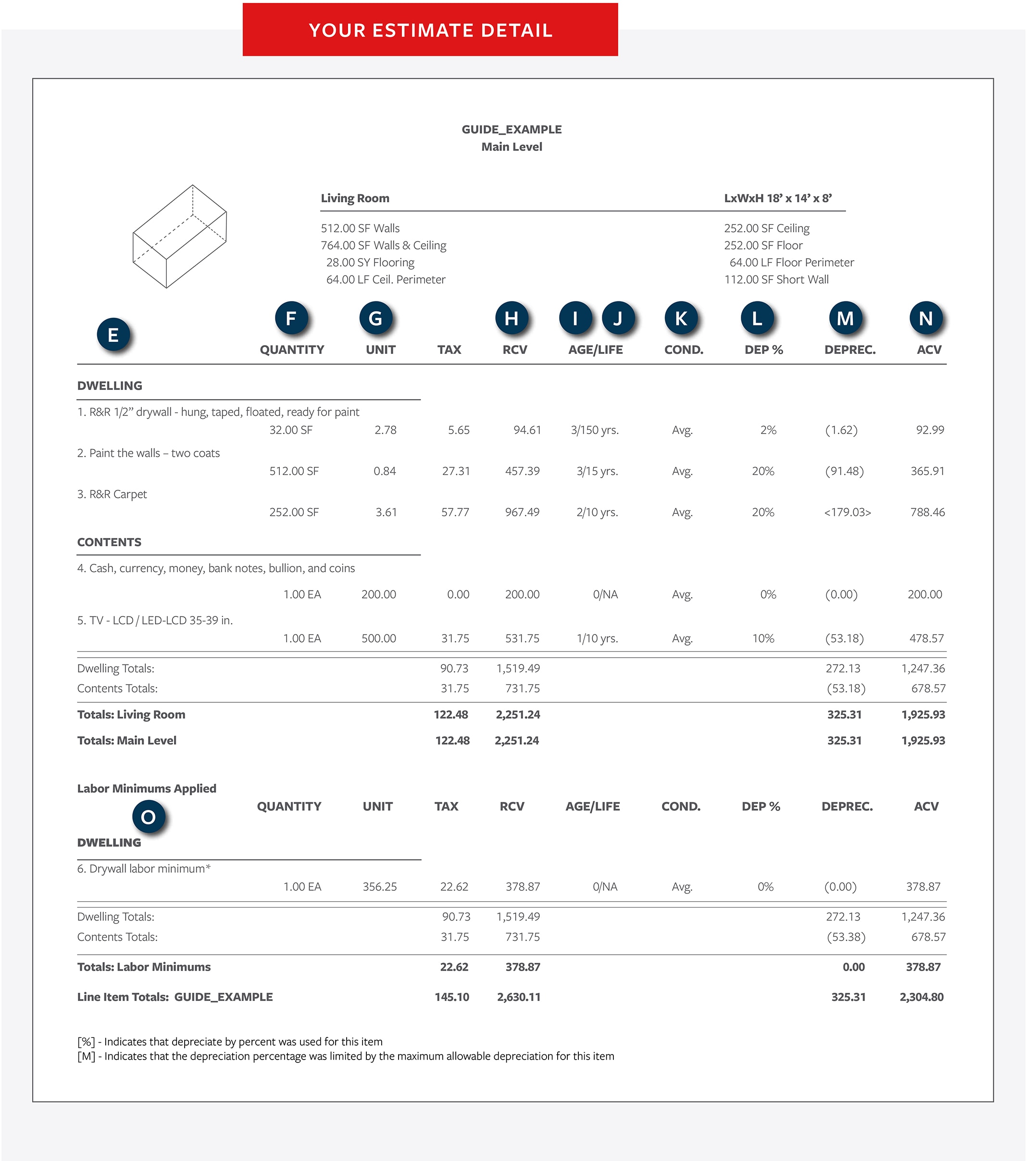

Understanding Your Property Estimate Travelers Insurance

Straight Line Depreciation Calculator And Definition Retipster

How To Analyze Reits Real Estate Investment Trusts Real Estate Investment Trust Real Estate Investing Investing

How To Use Rental Property Depreciation To Your Advantage

Understanding Your Property Estimate Travelers Insurance

Straight Line Depreciation Calculator And Definition Retipster

Payment Schedule Template Excel Unique 8 Printable Amortization Schedule Templates Ex Amortization Schedule Schedule Templates Mortgage Amortization Calculator